Need to Know

August 04, 2023An Antiquated Model

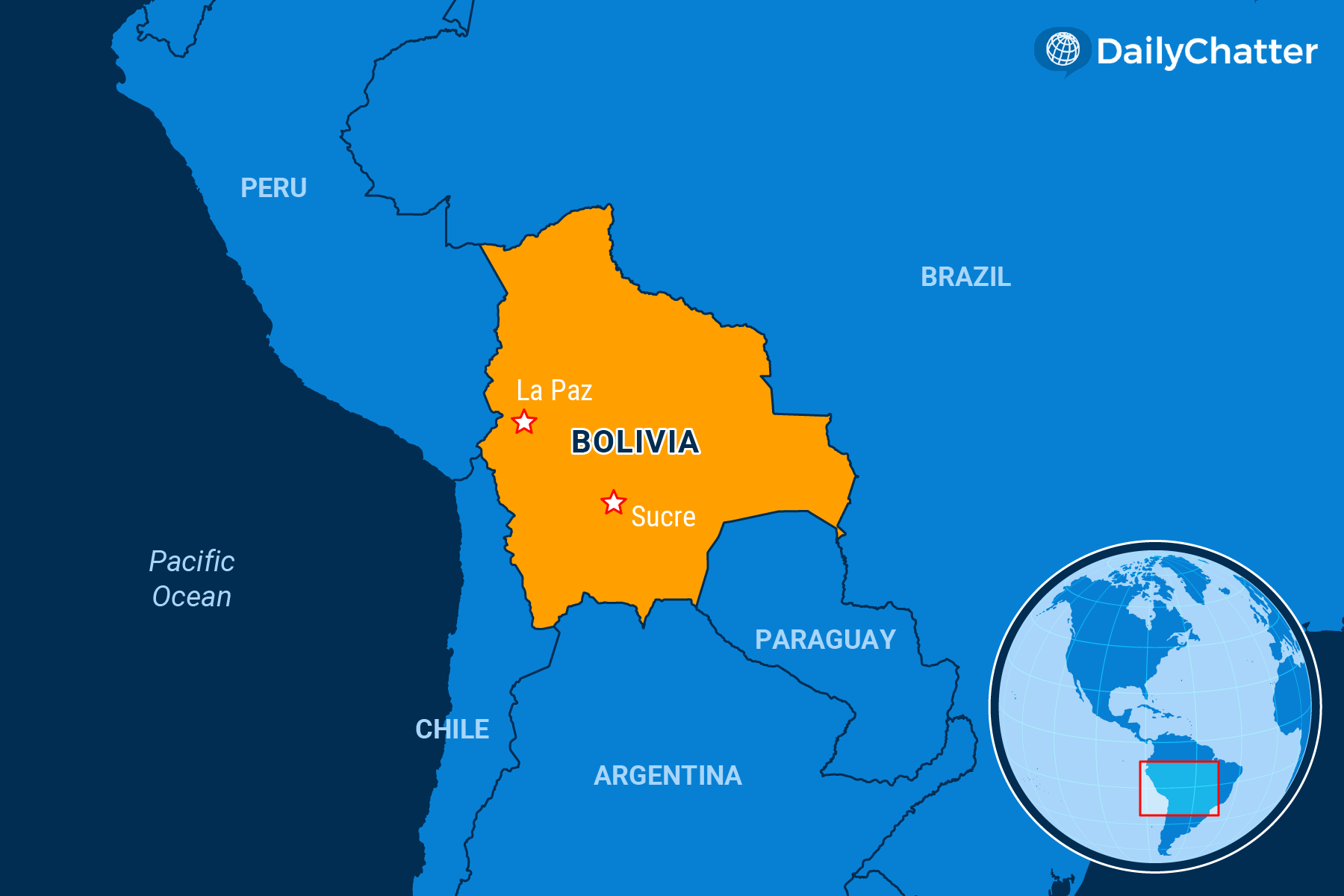

Bolivia

|

Listen to Today's Edition

|

China has invested more than a billion dollars in lithium and other mines in Bolivia. Former President Evo Morales and current President Luis Arce – both of the leftwing Movement for Socialism political party – actively cultivated this capital for years, reported the Diplomat.

Now, however, the negative implications of these economic policies are becoming clearer. Between 2005 and 2018, Bolivia increased exports to China 19-fold and increased imports by 12 times. The South American country’s debt to China, meanwhile, has ballooned 26-fold in the same period.

The country, say analysts, is on the verge of an economic crisis.

This growth looked good in its early stages. In the 2000s and 2010s, explained Reuters, Morales used revenues from commodities, especially natural gas, to spend on social welfare programs and help the country’s poorest people, especially those part of Indigenous communities that historically have suffered oppression and few opportunities.

In recent years, however, gas production has plateaued while inflation and other costs have skyrocketed. Analysts have even forecast that Bolivia might transition from becoming an exporter of natural gas to Argentina and Brazil to becoming a net importer by 2030, according to Merco Press.

As a result, the country today is now running out of cash to pay its bills, fund public services, and keep its financial system humming.

Earlier this year, for example, Bolivians queued up at banks to withdraw cash, especially American dollars, as a hedge against the value of their currency plummeting, the Economist wrote. The central bank stopped publishing data on Bolivia’s dwindling foreign currency reserves. The price of Bolivian bonds collapsed as foreign investors lost interest in them.

Experts are skeptical that Chinese help in mining lithium will deliver much. South American countries are notoriously dependent on commodities whose prices rise and fall, driving economic instability in the region. Bolivia has a history of high prices in natural resources causing boom and bust cycles that don’t lead to long-term growth.

“Bolivia’s case underscores how commodity booms distort the economy by promoting unproductive policies, allowing governments to pursue their wildest dreams and papering over their economic cost,” wrote Bloomberg columnist Eduardo Porter.

The value of Bolivian mineral exports to China, furthermore, is worth only 20 percent of the imports from China that Bolivians purchase, noted El País. Critics have also pointed out that Chinese companies – like many foreign companies invested in the continent – also foment corruption and ignore the environmental consequences of their operations when they work in the region.

Bolivia doesn’t need more cash so much as it needs a new way of spending it.

Not already a subscriber?

If you would like to receive DailyChatter directly to your inbox each morning, subscribe below with a free two-week trial.

Support journalism that’s independent, non-partisan, and fair.

If you are a student or faculty with a valid school email, you can sign up for a FREE student subscription or faculty subscription.

Questions? Write to us at hello@dailychatter.com.