The World Today for July 15, 2021

NEED TO KNOW

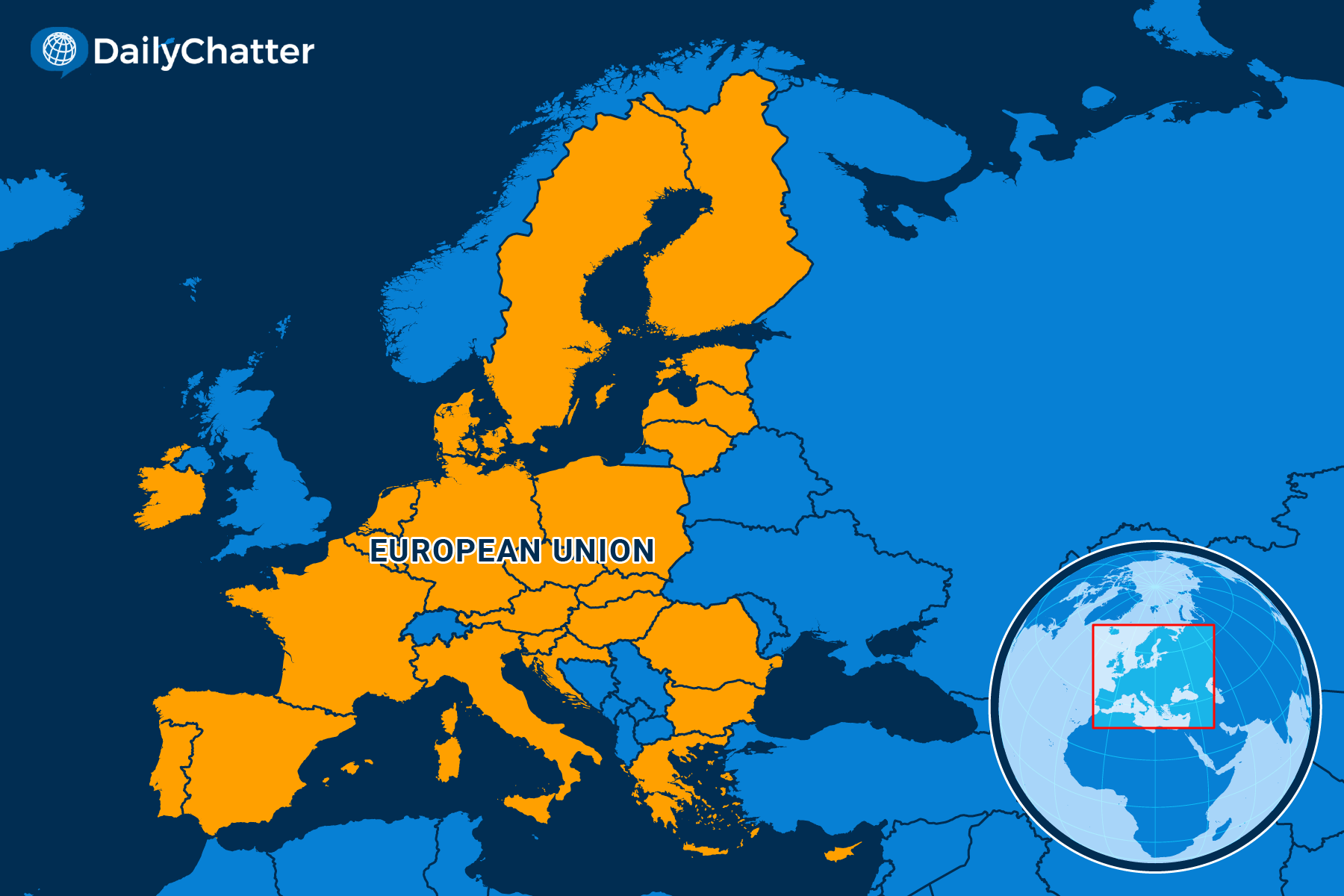

EUROPEAN UNION

No Borders

Leaders at Volvo, ArcelorMittal, BASF, Daimler, Iberdrola, Orsted, Thyssenkrupp, Titan Cement, Siemens, Shell and other storied and gigantic European companies recently issued a public letter in the run-up to the European Union unveiling new measures for the bloc to reach net-zero carbon emissions in 2050.

The business leaders thought European Union officials were moving too fast with the continent’s transition to a green energy economy. The bloc needs much more renewable energy if it wants to reach the standards the politicians were proposing.

“Without a stronger European policy focus and increased investments boosting the availability of renewables for industrial use, we not only risk delaying needed greenhouse gas reductions . . . but also our overall credibility,” went the letter quoted in the Financial Times. “We are still far from the needed volumes and capacity in terms of renewable energy.”

Among the expected measures were reforms to the European Union’s carbon pricing market, stricter car emissions regulations and a tax on carbon imports. Carbon pricing and cleaner cars are well-known ways to reduce greenhouse gas emissions. The proposed tax is unique.

A tax on imports is a tax on consumption. The so-called “carbon border tax” would target the carbon that Europeans would consume abroad when they purchase foreign goods or services. The tax would raise the costs of “steel, cement and aluminum produced in countries with lower environmental standards,” Bloomberg explained.

Brussels expects to raise almost $12 billion from the tax annually once it’s finalized in the next two years, according to S&P Global Platts.

In an article supporting the idea in Project Syndicate, researchers at the National University of Singapore’s Lee Kuan Yew School of Public Policy argued that the carbon tax is an important tool to suppress carbon emissions.

The tax captures carbon that countries often don’t calculate under the Paris climate agreement of 2015, they wrote. It also represents a fairer distribution of carbon-related costs. Emissions in the US have increased by 3 percent since 1990. But Americans’ consumption of carbon has increased by 14 percent in the same period. Americans are getting that carbon from foreign sources – that is, buying things that produce carbon abroad.

Europe’s trading partners are complaining that the tax is hardly fair, as Reuters reported. In response, the Europeans want the US, Japan and other wealthy nations to adopt their own carbon import taxes, Politico wrote.

Meanwhile, the climate keeps changing.

To read the full edition and support independent journalism, join our community of informed readers and subscribe today!

Not already a subscriber?

If you would like to receive DailyChatter directly to your inbox each morning, subscribe below with a free two-week trial.

Support journalism that’s independent, non-partisan, and fair.

If you are a student or faculty with a valid school email, you can sign up for a FREE student subscription or faculty subscription.

Questions? Write to us at [email protected].